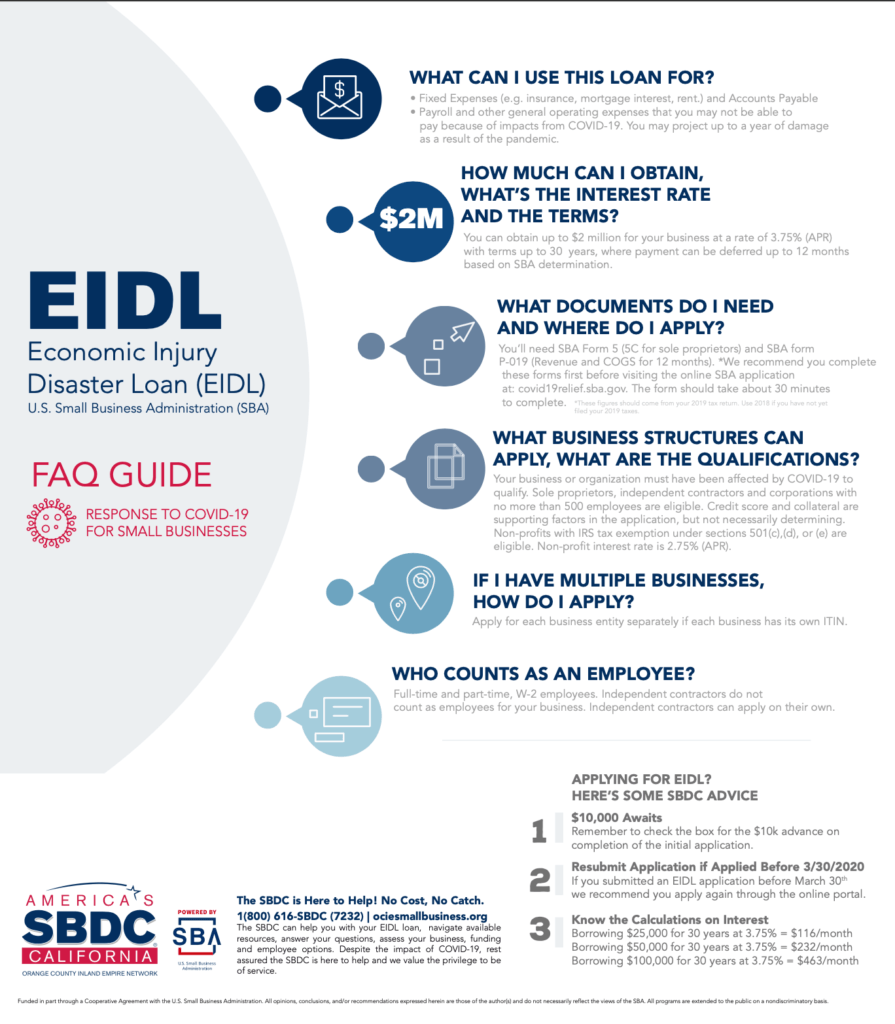

What Can I Use this Loan For?

- Fixed Expenses (e.g. insurance, mortgage interest, rent.) and Accounts Payable

- Payroll and other general operating expenses that you may not be able to pay because of impacts from COVID-19. You may project up to a year of damage as a result of the pandemic

How Much Can I Obtain, What’s the Interest Rate and Terms?

You can obtain up to $2 million for your business at a rate of 3.75% (APR) with terms up to 30 years, where payment can be deferred up to 12 months based on SBA determination.

What Documents Do I Need and Where Do I Apply?

You’ll need SBA Form 5 (5C for sole proprietors) and SBA form

P-019 (Revenue and COGS for 12 months).

* We recommend you complete these forms first before visiting the online SBA application at: covid19relief.sba.gov. The form should take about 30 minutes to complete.

* These figures should come from your 2019 tax return. Use 2018 if you have not yet filed your 2019 taxes.

What Business Structures Can Apply, What Are The Qualifications?

Your business or organization must have been affected by COVID-19 to qualify. Sole proprietors, independent contractors and corporations with no more than 500 employees are eligible. Credit score and collateral are supporting factors in the application, but not necessarily determining. Non-profits with IRS tax exemption under sections 501(c),(d), or (e) are eligible. Non-profit interest rate is 2.75% (APR).

If I Have Multiple Businesses, How Do I Apply?

Apply for each business entity separately if each business has its own ITIN.

Who Counts As An Employee?

Full-time and part-time, W-2 employees. Independent contractors do not count as employees for your business. Independent contractors can apply on their own.

Applying For EIDL? Here’s Some SBDC Advice

1. Up to $10,000 Awaits

Remember to check the box for up to a $10k advance on completion of the initial application.

2. Resubmit Application if Applied Before 3/30/2020

If you submitted an EIDL application before March 30th

we recommend you apply again through the online portal.

3. Know the Calculations on Interest

Borrowing $25,000 for 30 years at 3.75% = $116/month

Borrowing $50,000 for 30 years at 3.75% = $232/month

Borrowing $100,000 for 30 years at 3.75% = $463/month

The SBDC is Here to Help! No Cost, No Catch.

The SBDC can help you with your EIDL loan, navigate available resources, answer your questions, assess your business, funding and employee options. Despite the impact of COVID-19, rest assured the SBDC is here to help and we value the privilege to be of service.

EIDL FAQ Resource Guide

Download our FAQ Guide Here