New Employer Requirement

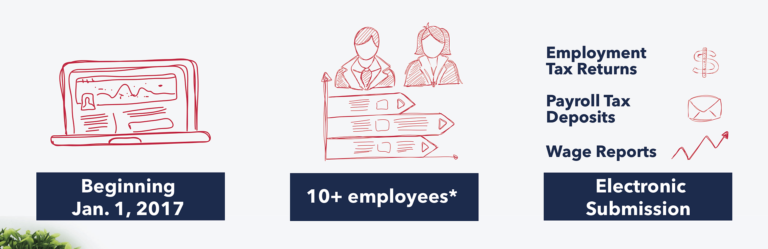

The California Assembly Bill (AB) 1245, also known as the e-file and e-pay mandate requires all employers to electronically submit employment tax returns, wage reports and payroll tax deposits to the Employment Development Department (EDD). This mandate is effective January 1, 2017 for employers with 10 or more employees and effective for all remaining employers January 1, 2018. Employers that are already required by law to electronically submit wage and/or electronic funds transfer to EDD will remain subject to those requirements in addition to this new mandate. The SBDC can help!

Our OCIE SBDC consultants can provide you with additional guidance regarding this new employer requirement and are trained through the EDD to assist you with enrollment in the e-Services for Business platform. Schedule an appointment with one of our consultants to learn more about the e-file and e-pay mandate, get help with electronically filing the required documents for your business and more. Use the button below to schedule your consultation.

More Information

According to the EDD, under the e-file and e-pay mandate the following forms must be submitted electronically:

- Quarterly Contribution Return and Report of Wages (DE 9).

- Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C)

- Employer of Household Worker(s) Quarterly Report of Wages and Withholdings (DE 3BHW)

- Employer of Household Worker(s) Annual Payroll Tax Return (DE 3HW)

- Quarterly Contribution Return (DE 3D)

- Payroll Tax Deposit (DE 88)

Penalties for Non-Compliance

| Tax Returns | DE 9 DE 3D DE 3HW | $50 per return |

| Wage Reports | DE 9C DE 3BHW | $20 per return |

| Payments | DE 88 | 15% of amount due |

| Note: These penalties are in addition to any other penalties that may apply. |

About e-Services for Business:

The EDD encourages employers to use e-Service for Business to file electronic documents in compliance with the e-file and e-pay mandate. e-Service for Business helps employers, employer representatives and payroll agents manage an employer paytoll tax account online 24/7 – at no cost. There is no additional software requirement needed to access these services. For more information or to create an e-Service for Business account, please visit https://www.edd.ca.gov/e-Services_for_Business.

Downloads:

E-FILE AND E-PAY MANDATE FOR EMPLOYERS – Information Sheet

E-file and E-pay Mandate – Tip Card

FAQs – E-file and E-pay Mandate (Assembly Bill 1245)

For more information and additional reading material about the the e-file and e-pay mandate, please visit https://www.edd.ca.gov/Payroll_Taxes/E-file_and_E-pay_Mandate_for_Employers.htm