The County of San Bernardino has created the Mountain Small Business Grant Program to provide direct financial assistance to San Bernardino County small businesses and non-profits impacted by the winter storm events that began on February 27, 2023. Two grant amounts are available to eligible small businesses and non-profits located in unincorporated mountain areas:

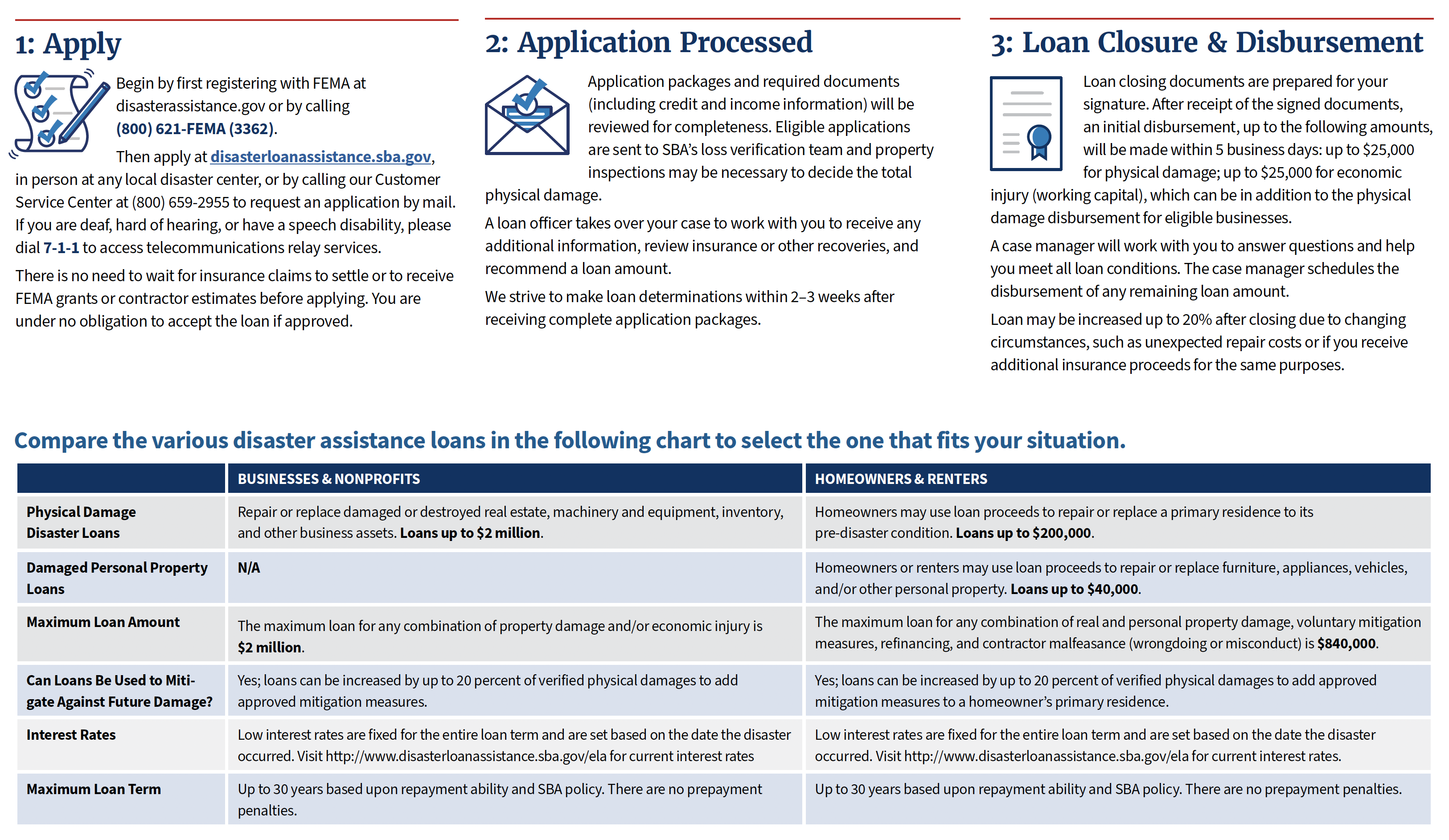

Today’s [03/10/2023] Presidential Declaration is an “EM” meaning that it unlocks emergency management resources but not financial assistance for residents or businesses. But this is part of a cascading chain of declarations. The next step would be a “DR” declaration of a Major Disaster Declaration. The incident date on that Major Disaster declaration would be the one to look for. When and if there is a disaster declaration from the federal government, the Economic Injury Disaster Loan (EIDL) will kick in. This is similar to the COVID program and offers a loan from the federal government through the SBA. The EIDL program is usually set at 3.75% for 30-years and allows up to $2,000,000 of funding, based on the economic injury of the business. To learn more about program, please visit the SBA website.

The SBA also will offer a Business Physical Disaster Loan on Real property, machinery, equipment, fixtures, and inventory for losses not fully covered by insurance. The Business Physical Disaster Loans are also only available once a disaster has been declared by the federal government. Learn more about this type of SBA disaster loan at Business Physical Disaster Loans (sba.gov).

For required documents, go to https://disasterloanassistance.sba.gov/ela/s/article/Paper-Forms.

The Small Business Finance Center’s Disaster Relief Loan Guarantee Program was created to help businesses recover from a declared disaster. The loan guarantees provided by the Disaster Relief Loan Guarantee Program help mitigate barriers to capital for small businesses that have suffered a loss (either physical or economic) due to a disaster. The program helps businesses remain solvent during an extremely difficult time and eventually recover from their losses.

Disaster Relief | California Infrastructure and Economic Development Bank (IBank)

Our consultants specialize in providing guidance in the loan packaging process and identifiying the right loan for individual bunsiesses from our network of more than 100 financial institution partners. In order to save you time and resources, we partner directly with underwriters to make the funding process easier and obtain a quicker response.

All the services provided by the Finance Center are at no cost, they are paid for by your tax dollars so take advantage! Any services are either conducted through confidential in-person meetings or video conference calls at California State University, Fullerton.

Home – OCIE SBDC (ociesmallbusiness.org)

In partnership with: